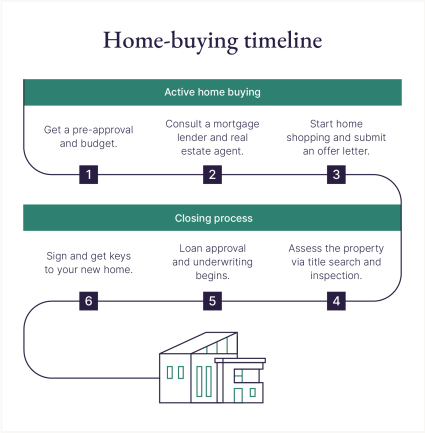

1. Get pre-approved for your new home

Mortgage pre-approval gives you buying power to make an offer on a home you love. Meeting with mortgage lenders to determine your loan options and secure pre-approval is the first step for any serious house hunter. Financing a second home still requires a down payment (depending on your loan type) and your mortgage will include an interest rate. In fact, some lenders have larger debt-to-income (DTI) ratio and down payment requirements, since second homes often come with a larger risk for the lender. While you may be pre-approved for a large loan, you should still use a budget to determine how much home you can afford. The pre-approval represents buying power, but you know better than your lender what is a reasonable monthly payment for your budget. Once you know your price range, you can start evaluating the homes and locations you’re interested in.Fully managed second homes

Affordability

To some extent, you can use your mortgage pre-approval as a baseline for your budget. It determines your buying power, so you can’t exceed that amount unless you have the cash available to make up the difference. Be careful, however: Your pre-approved amount may overestimate how much you can afford to pay each month. Make sure you build a proper budget before borrowing the full allotted amount. Budgeting for a new home isn’t just about your mortgage payments. Home inspection costs, closing costs, mortgage insurance and homeowners insurance are just a few of the additional costs to consider. Of course, furnishing your second home and the cost of moving can get expensive, too. Start to price out what you’ll need to buy immediately to enjoy your new home as part of your home-buying budget.2. Research your target destination

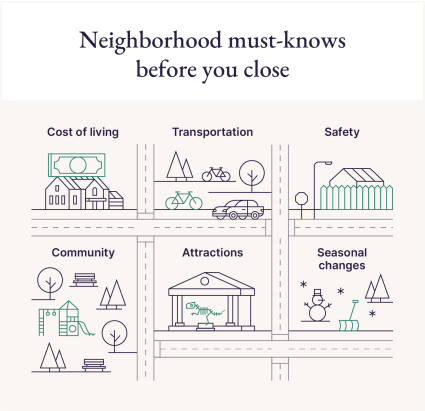

What you want out of your second home and where you want to live are huge factors that help you narrow your search and give you confidence that a home is right for you. If you’re buying in a larger city, see if there are tour videos on YouTube or local social media groups and Subreddits you can read. Local influencers or parenting blogs can provide a personal perspective of the area without ever making the trip. Consider these location factors to decide if a new town or city is right for you.

Property taxes

Property taxes are determined by the value of your property (land and structures) and the property tax rate. Property taxes vary by city, county and state, so where you decide to move can have major implications for your taxes. Many government sites have property tax calculators, so you can estimate how much you may be charged based on your buying budget and the local tax rates. However, these are estimates, and other influences, like recent renovations or local real estate market trends, can also impact your property taxes.Cost of living

Property taxes aren’t the only cost variable you should consider in your budget. Homeowners insurance, HOA requirements and utilities are all home costs that are likely different than your primary residence expenses, especially if you’re buying in a vacation hot spot. Beyond the home costs, you should consider how much you’ll spend while you’re in town. Groceries and restaurant bills, gas prices and entertainment expenses will also vary so you should set a reasonable budget for each.Attractions and amenities

Your vacation home is meant to be a comfortable space to relax with plenty of opportunities to explore and have fun. Consider what attractions you want near your new home:- Ocean beaches

- Lakes for boating

- Designer or artisan shopping

- Ski mountains

- Golf courses

Crime rate

Safety is an important factor when determining where you want to live. Especially if you’re buying a second home that may be vacant for long periods of time, you want to know your home and possessions are safe. Crime rate data from the FBI or city crime maps can help you research safety if you’re unable to visit a neighborhood. However, you should consider that crime data can be biased, and a safe neighborhood means something different for everyone. Visiting a location at all hours of the day will give you the best understanding of how comfortable a neighborhood is. If that isn’t feasible, check out local social media groups or apps to chat with residents and hear their experiences.Seasonal changes

Seasons can impact your personal mood, the entertainment options in a city and the maintenance needs of your new home. Decide ahead of time what you’re willing to live with as far as seasonal changes. If you’re looking for a beach home and hate the winter, consider southern beaches rather than northern East Coast residences that will need winter-proofing and receive heavy snow. Seasonal population changes are also valuable factors in your decision. Is your new home in a university town that will have summer slow-downs? Or is your new property in a tourist town where you’ll be one of many snowbirds flying in for the winter?Understanding what you want from a new town or city, and what seasonal weather or social changes may impact your experience, can help you choose the best neighborhood for your lifestyle.3. Visit the area

Even if you can only swing a weekend visit, seeing a prospective area in person is the best way to experience a new place and decide if it’s right for you. While visiting, think about:- How interactions with locals go

- What entertainment and amenities are available

- The culture of the town or city

- What daily life may look like

- The cost of restaurants, entertainment and shopping

4. Plan your home-buying process

Buying a house in another state follows the same home-buying process as buying a home across town, but it requires some additional planning to get everything organized. We’ve already covered the initial steps of finding a lender and determining a general location for your vacation home. Next, the active part of home buying picks up as you chat with real estate agents, start considering active listings and get your paperwork in order to submit an offer.

- Preferred communication among your home-buying team

- Contact information for agents, lenders, etc.

- Important dates like holidays or current lease expiration

- Goals like a date to start getting inspection quotes

- Assigned responsibilities among home buyers

Home preferences

Before you consult a real estate agent and start house shopping, you should decide what type of house and features you want. Start having conversations with your family about what they want from a vacation home and what you need to be comfortable. Making a list of your wants and needs will help you compromise when house hunting and provide a baseline for when you should make an offer. Wants and needs are subjective, though. A family with a large dog may believe a yard is an absolute must, while someone else who hates yard work may decide a yard is an immediate no. Sharing the style of house you want, your needs and wants, and your neighborhood preferences will help your home-buying team find your perfect vacation home.5. Find a local buyer’s agent

Your real estate agent is a major asset when shopping for a new house, especially if you’re out of state. Finding the right buyer’s agent in another city can be tough, but online reviews, video conferences and phone calls make it easier than ever to decide who’s right for you.

6. Get videos and tour virtually

When you can’t tour a home in person, the next best things are virtual tours, videos and listing pictures. Many online home listings even include floor plans so you get a better feel for a home’s layout. A good agent will take you on a virtual tour of a home via FaceTime or Zoom. They’ll help you get an honest look at the property and highlight positives or concerns based on your needs and wants. Even if you can visit a home in person, be sure to take videos and photos so you can revisit your open house experience when deciding if you want to make an offer. It also allows you to share the home with your family and friends to get their opinions.7. Explore local property management costs

Property management costs like lawn care, cleaning, repairs and routine servicing can vary significantly between cities and states, especially if your new vacation home is in a popular tourist destination. If you’re going to be the only resident of the home, you can work with contractors as needed to maintain your property while you’re away. If you want to offer short-term rentals between your stays, a full-service property management company may be worth investing in. With year-round residents, maintenance needs will increase, and you’ll be responsible for any repairs needed to provide a safe and comfortable home for tenants. A property management company would be helpful in taking care of these concerns while you’re at home across state lines.8. Get your finances in order

A second home will add to your recurring home ownership expenses (mortgage payments, insurance and utilities). The actual mortgage process for purchasing a second home also varies from purchasing a primary residence. You may also find your pre-approval includes a higher interest rate than you expected based on your first home-buying experience. Because second homes also mean a second mortgage and increased costs, lenders increase interest rates to accommodate the extra risk associated with a second loan.

9. Find a trusted title agency

Title agencies are responsible for digging into the details of the property’s previous owners, property structures and property lines. This is called a title search, which ensures that the current owner selling the property has full authority to do so.Financing companies will often choose a title company and oversee this process, but some states require that the buyer find a title agency. Your real estate agent and mortgage lender will be able to tell you who’s responsible for this step and can provide recommendations for reputable title companies. Title searches identify anyone who owns or has a right to the property via liens. This is important because it validates your home ownership after closing so nobody else can claim the property. Additionally, any open and undisclosed liens, like unpaid property taxes, can become your responsibility once you purchase the home. If a title search was run, the title company takes responsibility for missing these details in the title search.10. Get a house inspection

A home inspection is another important step toward closing on your new home. Unlike the title search, a house inspection isn’t required to purchase a home, but it is highly advised. A professional home inspector will check the home’s exterior and roof, interior, electrical, plumbing, appliances and more to make sure the home is move-in ready and doesn’t require any major repairs. After the inspection, you’ll receive a report detailing what they found, including any necessary repairs or concerns. At this point, you as the buyer have the power to re-negotiate the home’s sale price considering repairs, ask the seller to complete repairs before you close, or exit the deal without repercussions. Buyers who waive a house inspection agree to buy a property as-is, which means a leaking roof or electrical shortage is entirely your responsibility once you complete the transfer of ownership.11. Buy your second home

Once you’ve chosen a destination, found the perfect home, had your offer accepted, and wrapped up every step of the closing process, it’s time to finally enjoy your new vacation home!There’s no doubt that learning how to buy a house in another state includes a lot of steps, organization and time. Luckily, buying a second home is easier with Pacaso. You can:- Browse luxury second home listings

- Book a virtual or in-person tour

- Secure flexible financing

- Co-own a fully managed, turnkey property in more than 40 world-class destinations